In the video summary titled “3 Forgotten Truths from Rich Dad Poor Dad,” presented by Jason Wardrop, you’ll discover key concepts from the book by Robert Kiyosaki. The first truth emphasizes the distinction between liabilities and assets using examples like car payments and rental properties. The second truth delves into the concept of creating assets to invest in other assets, such as starting a YouTube channel or a marketing agency. Lastly, the third truth focuses on the benefits of creating a business and using pre-tax dollars for investments and expenses. By revisiting or exploring “Rich Dad Poor Dad,” you can gain a deeper understanding of these wealth-building principles.

Benefits of Creating a Business for Wealth Building

Introduction

Are you looking for ways to build wealth and create a secure financial future? One powerful strategy that has been proven successful is creating a business. By becoming an entrepreneur, you open up a world of opportunities to generate income, acquire assets, and ultimately build wealth. In this article, we will explore the benefits of creating a business for wealth building, including the difference between liabilities and assets, examples of creating assets, and the advantages of using pre-tax dollars for investments and expenses.

The Difference Between Liabilities and Assets

Before we delve into the benefits of creating a business, it’s important to understand the difference between liabilities and assets. According to Robert Kiyosaki’s book “Rich Dad Poor Dad,” a liability is something that takes money out of your pocket every month, while an asset is something that puts money into your pocket. For example, a car payment is considered a liability because it requires monthly payments that deplete your income. On the other hand, owning a rental property is an asset because it generates monthly rental income, increasing your cash flow.

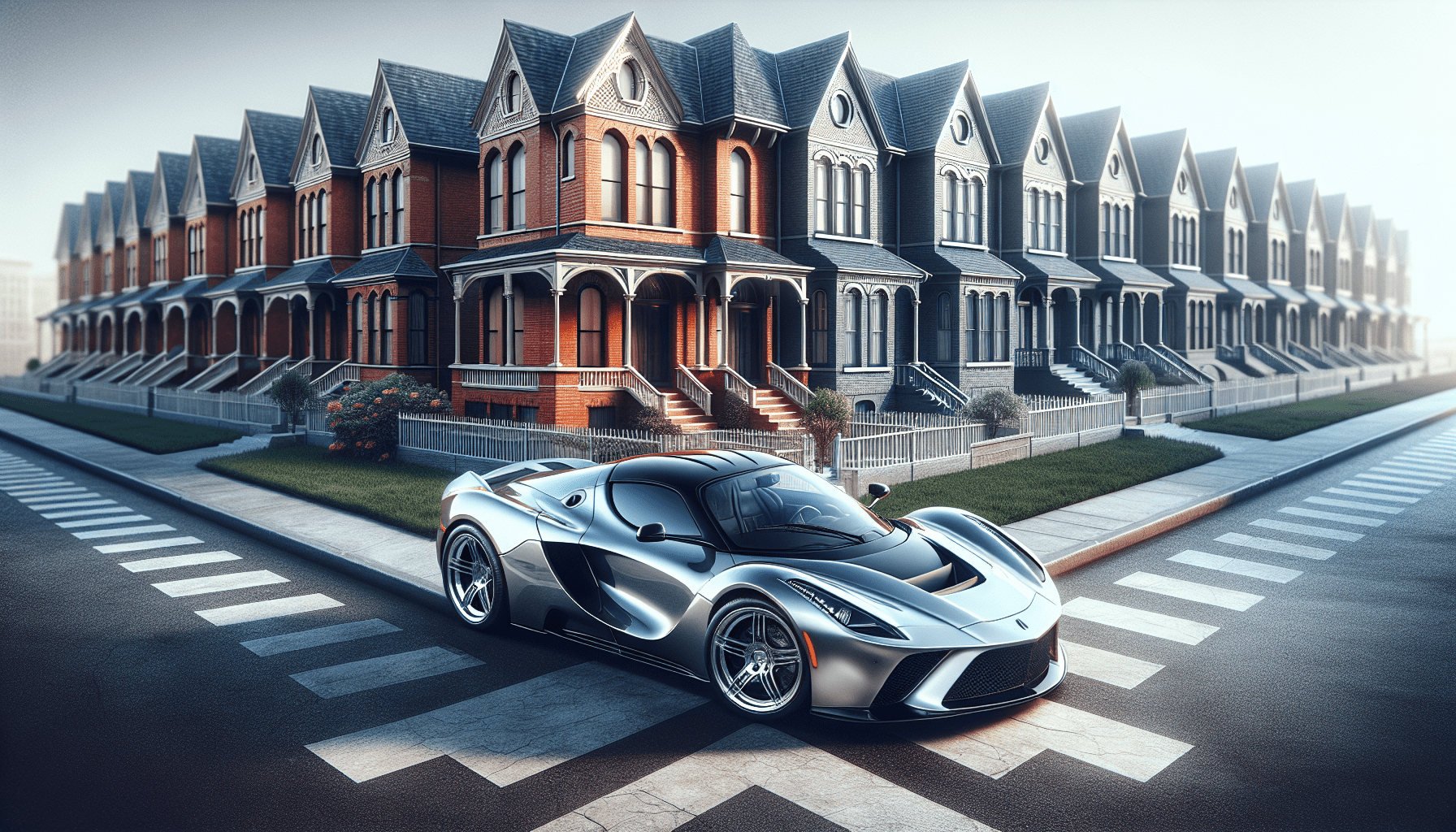

Examples of Liabilities: Car Payments

Let’s take a closer look at the example of car payments. Many people rely on cars for transportation, but oftentimes, car expenses can become a burden on their finances. Monthly car payments, insurance, and maintenance costs can add up, leaving less money available for other investments. By recognizing car payments as a liability, you can start thinking creatively about how to turn this liability into an asset. One way to achieve this is by renting out your car through apps like Turo. By doing so, you can generate income from your car and potentially cover your monthly car payments, effectively transforming the liability into an asset.

Examples of Assets: Rental Properties

Now, let’s explore the concept of assets, using rental properties as an example. Investing in real estate and owning rental properties is a popular way to build wealth. The key advantage of rental properties is the ability to generate passive income through monthly rental payments. With each rental property you own, you increase your cash flow and start building wealth over the long term. By investing in assets like rental properties, you are putting your money to work for you, instead of having it tied up in liabilities.

Creating Assets to Invest in Other Assets

One powerful concept highlighted in “Rich Dad Poor Dad” is the idea of creating assets to invest in other assets. This strategy involves starting a business that generates income, which can then be used to invest in further assets. By doing so, you create a cycle of wealth building, where the income from one asset is used to acquire additional assets.

Examples of Creating Assets: Starting a YouTube Channel

One way to create an asset is by starting a YouTube channel. YouTube offers the opportunity to monetize your content through ads, sponsorships, and other revenue streams. By consistently creating valuable and engaging content, you can grow your audience and generate income from your channel. The income generated from your YouTube channel can then be used to invest in other assets, such as stocks, real estate, or starting another business.

Examples of Creating Assets: Starting a Marketing Agency

Another example of creating an asset is starting a marketing agency. Many local businesses struggle with lead generation, Facebook advertising, and other marketing aspects. By offering your expertise and services, you can help these businesses grow and earn a monthly fee in return. This monthly income can be used to invest in other assets, such as stocks, mutual funds, or expanding your marketing agency further.

The Benefits of Creating a Business

There are several benefits to creating a business for wealth building. First and foremost, it allows you to generate income independently, giving you control over your financial destiny. As a business owner, you have the flexibility to determine your own working hours, rates, and overall business strategy. Additionally, creating a business provides an opportunity for personal and professional growth. Running a business challenges you to develop new skills, stay adaptable, and foster a mindset of continuous improvement.

Using Pre-Tax Dollars for Investments and Expenses

One significant advantage of creating a business is the ability to use pre-tax dollars for investments and expenses. As an employee, your income is usually subject to taxes before you receive it. However, as a business owner, you have the opportunity to deduct certain business expenses and investments as tax write-offs. This means you can invest in assets and deduct the expenses associated with them before calculating your taxable income. By utilizing pre-tax dollars, you can potentially save money on taxes and allocate more funds towards wealth-building activities.

Conclusion

Creating a business offers numerous benefits for building wealth and securing a financially prosperous future. By distinguishing between liabilities and assets, you can identify opportunities to turn liabilities into assets and generate passive income. Through creating assets, such as starting a YouTube channel or a marketing agency, you can cultivate a cycle of wealth building and reinvestment. Furthermore, the advantages of using pre-tax dollars for investments and expenses can provide significant tax savings and further accelerate your wealth-building journey. Remember, the key to success is taking action and continuously educating yourself on wealth-building strategies. So, start exploring the possibilities and take control of your financial future by creating a business today.